As Diwali approaches, many employers love to share joy through cash bonuses, vouchers, or festive hampers. But before you send those gift boxes or credits, here’s something every business and employee should know 👇

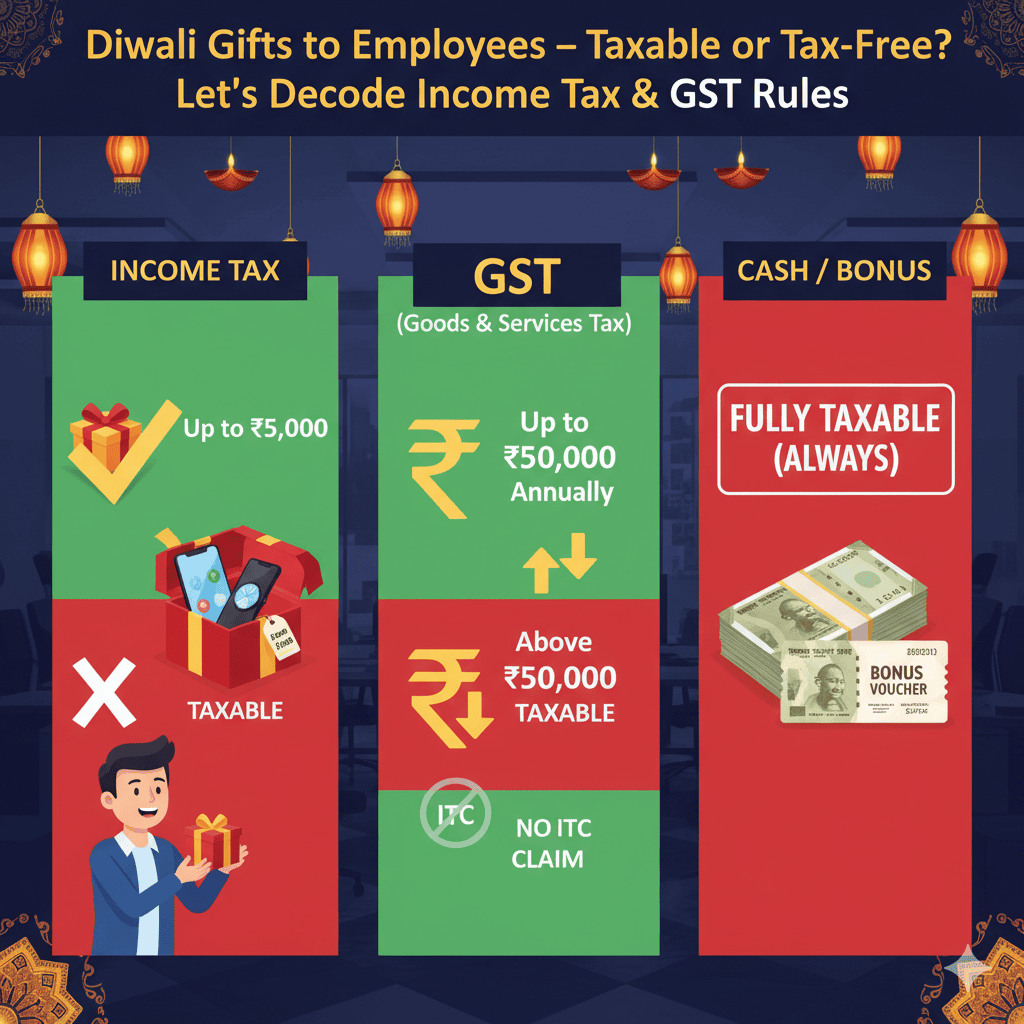

🪔 1️⃣ Gifts Under Income Tax – What’s Tax-Free?

The Income Tax Act allows tax-free gifts up to ₹5,000 per employee per financial year 🎉

✅ If total gift value ≤ ₹5,000:

→ Completely tax-free for the employee

❌ If total gift value > ₹5,000:

→ The entire amount becomes taxable under “Salary Income” and must be added to the employee’s taxable salary

💡 Examples:

Diwali sweet box worth ₹3,000 → Tax-free

Amazon voucher worth ₹7,000 → Entire ₹7,000 taxable

🔸 This limit applies to non-cash gifts only (like vouchers, hampers, or items). Cash gifts are always taxable.

💸 2️⃣ For Employers – How to Record It

Show it as a staff welfare expense or employee benefit in your books.

If gifts exceed ₹5,000, TDS on salary should be deducted accordingly.

🧾 3️⃣ GST Implications on Employee Gifts

Here’s where things get a bit technical — but don’t worry, we’ll simplify 👇

According to Section 7(1)(c) of the CGST Act, gifts to employees are considered “supply”only if:

They are made without consideration (free), and

The value of such gifts exceeds ₹50,000 per employee per financial year

✅ If total value ≤ ₹50,000:

→ No GST applies

❌ If total value > ₹50,000:

→ Treated as “deemed supply” and GST is payable by the employer on the excess amount

💡 Example:

Gift worth ₹60,000 → GST applies on ₹10,000

⚖️ 4️⃣ Input Tax Credit (ITC) on Gifts

No ITC is allowed on goods or services used for giving gifts to employees.

→ Section 17(5) of GST Act blocks ITC on gifts.

So even if you paid GST on purchasing gift hampers, you cannot claim that GST back.

🏮 5️⃣ Quick Summary Table

| Scenario | Income Tax Impact | GST Impact |

|---|---|---|

| Gift ≤ ₹5,000 | Tax-free for employee | No GST |

| Gift > ₹5,000 | Fully taxable in salary | GST applicable if total > ₹50,000/year |

| Cash gift | Always taxable | No GST (since cash not “supply”) |

| Employer ITC | Not available | Not available |

💬 6️⃣ Key Takeaway

Festive gifts boost employee morale — but knowing the tax treatment helps avoid future notices or disallowances.

🎇 Keep it under ₹5,000 (for income tax) and ₹50,000 (for GST) to stay compliant and stress-free!

Celebrate responsibly — and stay tax smart this Diwali! ✨