Introduction

Let’s understand what changed, why RBI made these rules, and what it means for ordinary people like us 👇

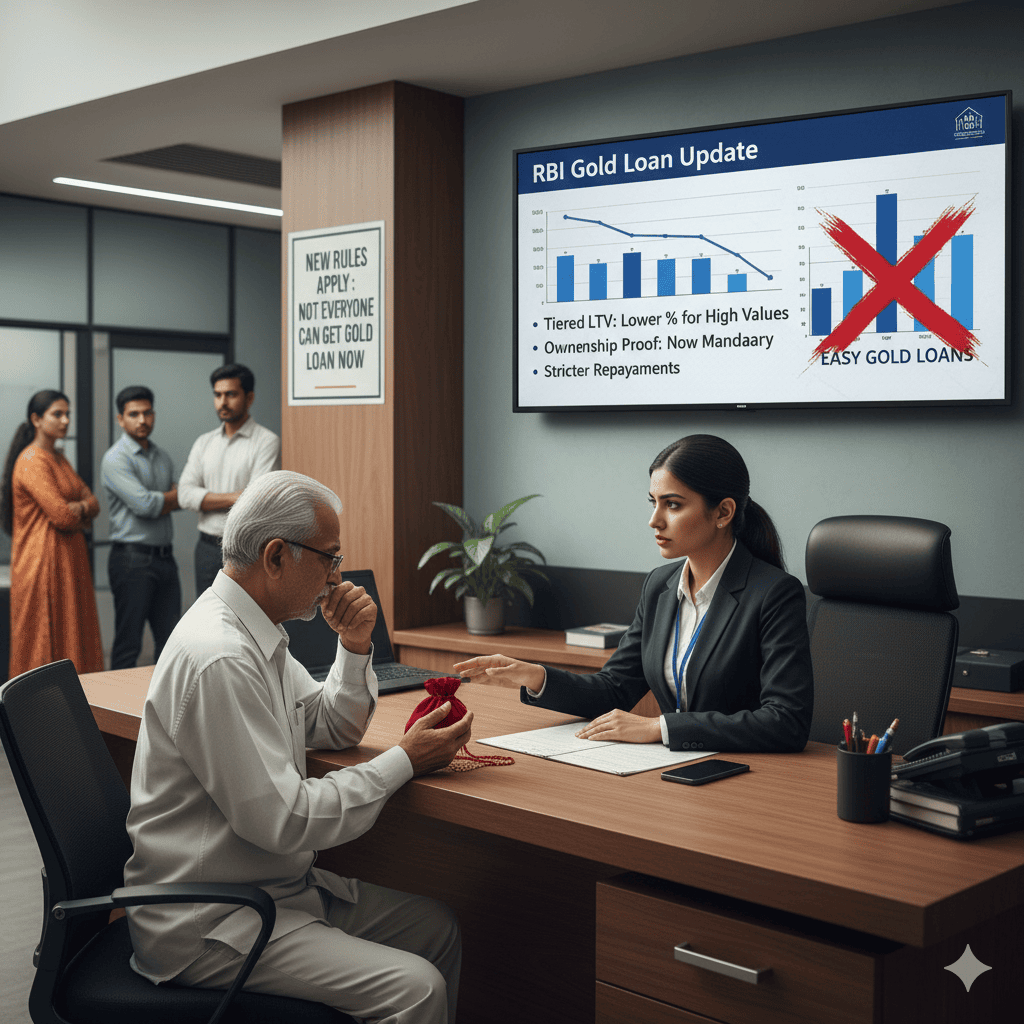

⚖️ What Has Changed? – The Big Update

Here’s a simple breakdown of the new RBI gold loan rules:

1️⃣ No Loan to Buy More Gold

From now on, you can’t take a gold loan to buy gold (or silver) again.

Earlier, some people took gold loans and used that money to buy more jewellery or coins — now that’s completely banned.

2️⃣ New Limit on How Much You Can Borrow

RBI has revised the Loan-to-Value (LTV) ratio — that’s how much loan you get against your gold.

| Loan Amount | Maximum Loan Allowed |

|---|---|

| Up to ₹2 lakh | 85% of gold value |

| ₹2.5 to ₹5 lakh | 80% of gold value |

| Above ₹5 lakh | 75% of gold value |

This will apply from April 2026 onwards.

So, higher the loan, lesser the percentage you can get.

3️⃣ Must Repay Full Loan (No More Rolling Over)

Earlier, people just paid interest and kept renewing the gold loan every few months.

Now, you must repay both principal and interest within 12 months — no unlimited extensions.

4️⃣ Lender Must Return Gold Fast

Once you clear your loan, your gold must be returned within 7 working days.

If the lender delays, they’ll have to pay ₹5,000 per day as penalty.

Fair deal, right? 😌

5️⃣ Transparent Gold Valuation

RBI now wants fair and clear gold valuation.

Value will be based on average price of last 30 days or previous day’s rate, whichever is lower.

Stones, designs, and making charges won’t count — only the pure gold weight will be considered.

6️⃣ If You Miss Payments – Auction Rules Become Stricter

If you don’t repay the loan:

The lender must give you proper notice before selling your gold.

Auction must start at 90% of market value, and even if it drops, it can’t go below 85%.

After the sale, any extra amount (after adjusting your dues) must be returned to you within 7 days.

🧍♀️ Who Will Be Affected?

Regular people taking small gold loans for emergency cash

Jewellery traders or artisans using gold as raw material

Businesses pledging gold for working capital

However, small borrowers (under ₹2.5 lakh) will get some relief — they won’t need to go through any complex income checks or credit appraisal.

📅 When Will It Start?

From 1st October 2025: Banks and NBFCs must follow the new process

From 1st April 2026: It will apply to borrowers too

💡 Why RBI Brought These Changes

RBI noticed that:

Gold loans were growing very fast — leading to risk for lenders and borrowers

Many lenders were undervaluing gold or not following proper auction rules

Borrowers were being misled or overcharged

So, the goal is to make gold loans safer, more transparent, and fair for everyone.

🧾 Key Takeaways for You

✅ Don’t use gold loan money to buy more gold

✅ Repay within 12 months — no endless renewal

✅ Ask your lender how gold is valued — get it in writing

✅ If they delay returning your gold, ask for ₹5,000/day penalty

✅ Prefer regulated banks/NBFCs over local financiers

🪙 Final Thought

Gold loans are still a great short-term help — but now, you’ll need to plan smarter.

Borrow only what you truly need, understand the repayment clearly, and always choose a trusted lender.

These rules are not to stop you — they’re here to protect you and your gold. 💛