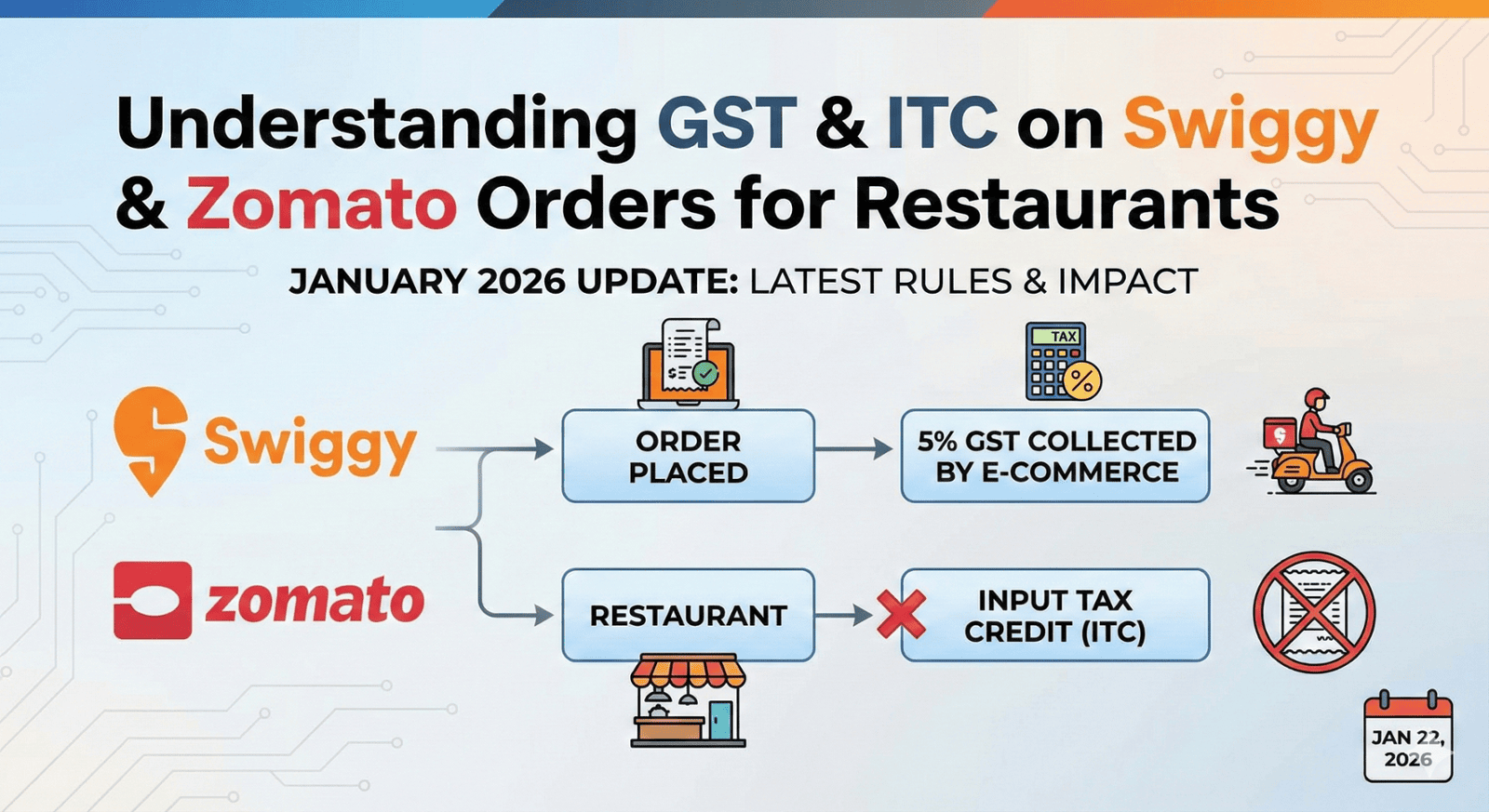

Online food delivery through Swiggy and Zomato has become a major part of restaurant business. However, many restaurant owners are confused about GST liability, ITC eligibility, and return filing for these transactions.

This blog explains the GST treatment of Swiggy & Zomato orders in simple, practical terms, specifically for food & beverage businesses.

🍽️ Nature of Supply – Restaurant Service via Swiggy & Zomato

When a restaurant supplies food through Swiggy or Zomato, it is still treated as restaurant service under GST law.

Mode of supply: Online (E‑commerce Operator)

Nature of service: Food & Beverage (Restaurant Service)

Applicable GST Rate

GST @ 5%

Input Tax Credit (ITC) – NOT allowed

This condition is mandatory when supplying food through Swiggy or Zomato.

👥 Who Pays GST on Food Orders?

Under Section 9(5) of the CGST Act:

Swiggy / Zomato collects and pays 5% GST on food value to the Government

Restaurant does not pay GST on food value for online orders

However, the restaurant must still report the sales value in GST returns.

❌ ITC Not Allowed – Very Important Rule

If your business activity is only food & beverages, and you charge 5% GST, then:

No Input Tax Credit is allowed on any purchase or expense, even if GST is charged on the invoice.

This applies fully to Swiggy and Zomato orders.

🚫 ITC NOT Allowed on Swiggy & Zomato Related Expenses

Restaurants cannot claim ITC on the following expenses related to online orders:

Online Platform Expenses

Swiggy / Zomato commission

GST charged @18% on Swiggy / Zomato commission

Cancellation charges

Advertisement or promotional charges billed by platforms

Food & Kitchen Expenses

Raw materials (rice, oil, vegetables, meat, milk)

Packaging materials used for delivery

LPG / cooking gas

Kitchen equipment & repairs

Other Business Expenses

CA / accounting fees

POS or billing software

Advertising & marketing expenses

Furniture, tables, chairs, AC, refrigerator

👉 Even though GST is charged on these invoices, ITC is blocked.

📊 Example – How Settlement Works

Order value collected from customer: ₹1,000

Commission charged by Swiggy/Zomato (20%): ₹200

GST on commission @18%: ₹36

Settlement received by restaurant: ₹764

GST Treatment

Sales to be reported: ₹1,000

GST payable by restaurant: NIL

GST on commission: Expense (No ITC)

📘 How to Report Swiggy & Zomato Sales in GST Returns

GSTR‑1

Report gross food sales (before commission)

Declare under Table 15 – Supplies made through E‑commerce Operators

Mention Swiggy / Zomato GSTIN

GSTR‑3B

Show sales value under Table 3.1(c)

GST payable: NIL (already paid by ECO)

ITC tables: NIL

🚨 Common Mistakes by Restaurants

Claiming ITC on Swiggy/Zomato commission GST

Reporting only settlement amount as turnover

Missing Table 15 in GSTR‑1

Assuming ITC is allowed on CA fees or software

These errors often lead to GST notices and reversals with interest.

🧠 Simple Summary

For restaurants supplying food through Swiggy or Zomato and charging GST at 5%, Input Tax Credit is not allowed on any expense, including platform commission GST.

✅ Professional Tip

Restaurants should:

Download monthly Swiggy/Zomato reports

Reconcile gross sales vs settlements

Avoid ITC claims completely

Take professional review before filing GST returns