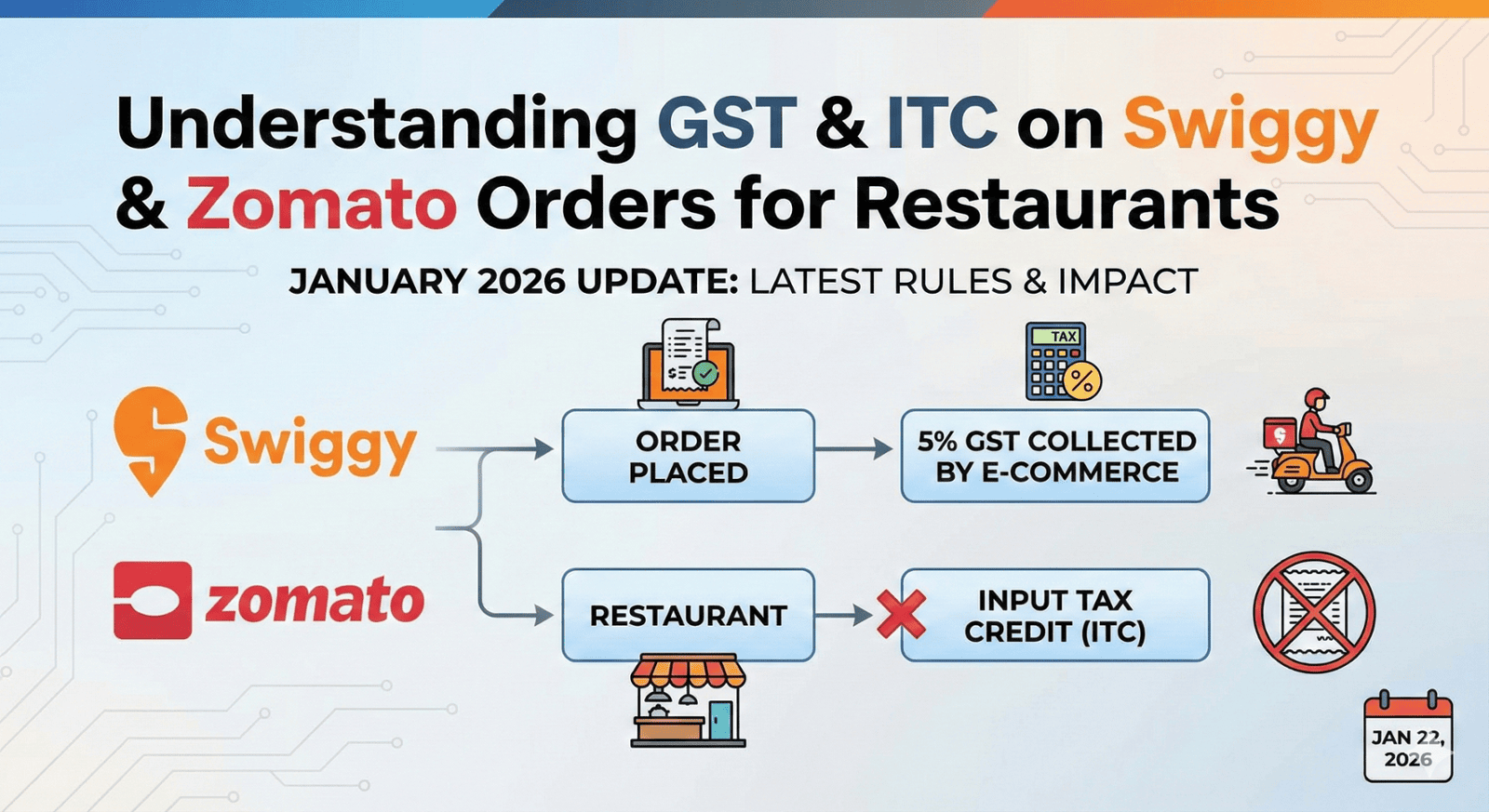

Online food delivery through Swiggy and Zomato has become a major part of restaurant business. However, many restaurant owners are confused about GST liability, ITC eligibility, and return filing for these transactions.

22.01.26 02:57 AM - Comment(s)