The Goods and Services Tax (GST) has changed the way we pay taxes, but as rates undergo another round of rationalization in 2025, taxpayers wonder: What’s going to get cheaper, and what won’t?

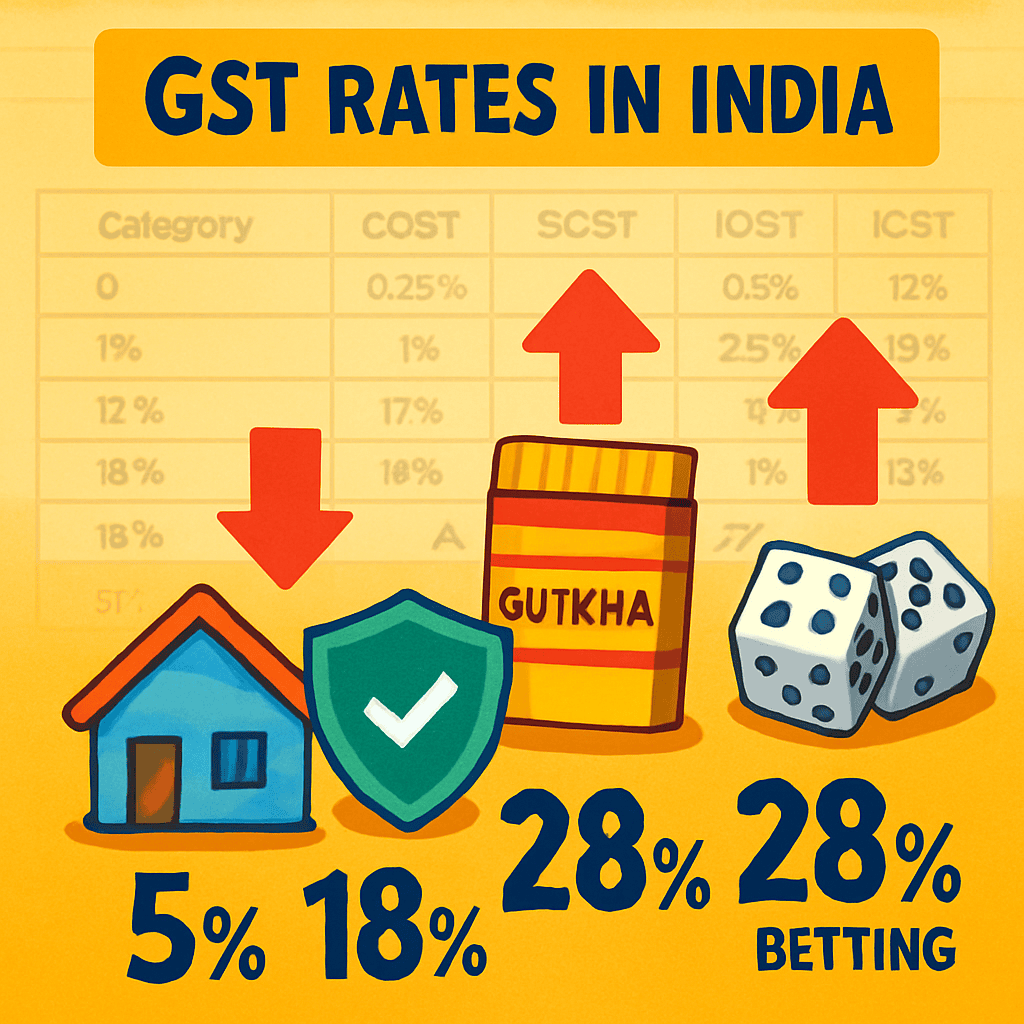

This year’s expected changes show a clear trend — essentials and growth sectors are set to get relief, while harmful or luxury categories may face higher taxes.

1. Insurance at 5% – A Big Win for Families

Insurance is no longer a luxury — it’s a necessity. But high GST has kept many away.

Then: Around 18% GST made health & life insurance premiums feel expensive.

Now (Expected): Just 5% GST on premiums.

Impact in Simple Terms: A ₹10,000 policy will now cost you ₹10,500 instead of nearly ₹11,800 — saving your family ₹1,300 instantly.

Bigger Picture: More people will be insured, reducing crisis-time money problems and improving financial stability.

✅ Insurance becomes affordable, and financial security grows.

2. Cement at 18% – Affordable Homes & Stronger Infrastructure

Cement is the foundation of housing, roads, bridges, and India’s growth. But it has long carried 28% GST, which made construction expensive.

Then: 28% GST made homes and infrastructure costly.

Now (Expected): 18% GST.

Impact in Simple Terms: Building a ₹10 lakh house could see savings of ₹40,000–₹50,000.

Bigger Picture: Cheaper homes, boost to affordable housing projects, and a surge in construction jobs.

✅ Homes cheaper, jobs rise, infrastructure quicker.

3. Heavier Taxes on Harmful Products

Not everything should be cheaper. Harmful items are expected to see steep GST increases, even up to 500% more.

Gutkha & Tobacco: Higher prices will discourage use, reduce health problems, and save families from huge medical bills.

Online Betting & Gambling: Addictive apps and websites may get heavily taxed, limiting their lure for youngsters.

Impact in Simple Terms: Bad habits costlier, good habits rewarded.

Bigger Picture: Higher government revenue, healthier population.

4. Snapshot: Other Key Product Categories

Here’s where other goods & services may stand after GST changes:

| Category | Current GST | Expected After Cut/Change | Effect on You |

|---|---|---|---|

| Food essentials (grains, veg, milk) | 0% – 5% | No major change | No extra burden |

| Packaged food & snacks | 12% | Likely 5–12% | Everyday items a bit cheaper |

| Household items (paint, tiles, steel) | 18–28% | May reduce to 18% | Construction & renovation cheaper |

| Two-wheelers & small cars | 28% + cess | May see small cut | Budget vehicles slightly cheaper |

| Luxury cars, hotels, alcohol | 28%+ | Likely unchanged or higher | Remains expensive |

| Banking services (loans, fees) | 18% | May reduce to 12% | Reduced bank charges possible |

5. What It Means for You in Plain Words

Middle Class Families → Insurance will cost less, and building or buying a house will be easier.

Homebuyers & Real Estate Sector → Cement tax cut means a huge relief in construction costs and property prices.

Youth → While essentials get cheaper, addictive activities like betting and tobacco will pinch the pocket.

Government → May earn less from tax cuts on essentials but will balance it by taxing harmful items more

Final Thoughts: Balanced Relief with Responsibility

This mix of GST cuts and hikes shows a smart policy approach:

Essentials like insurance and housing inputs get cheaper → helping families and growth.

Harmful habits like gutkha and online betting get taxed harder → protecting health and society.

Everyday items get mild relief → keeping inflation in check.

👉 In simple terms:Good things will cost less. Bad habits will cost more. And India will move toward a fairer tax system.