(Explained in Simple Layman Terms)

The GST Network (GSTN) has issued an important update regarding the reporting of:

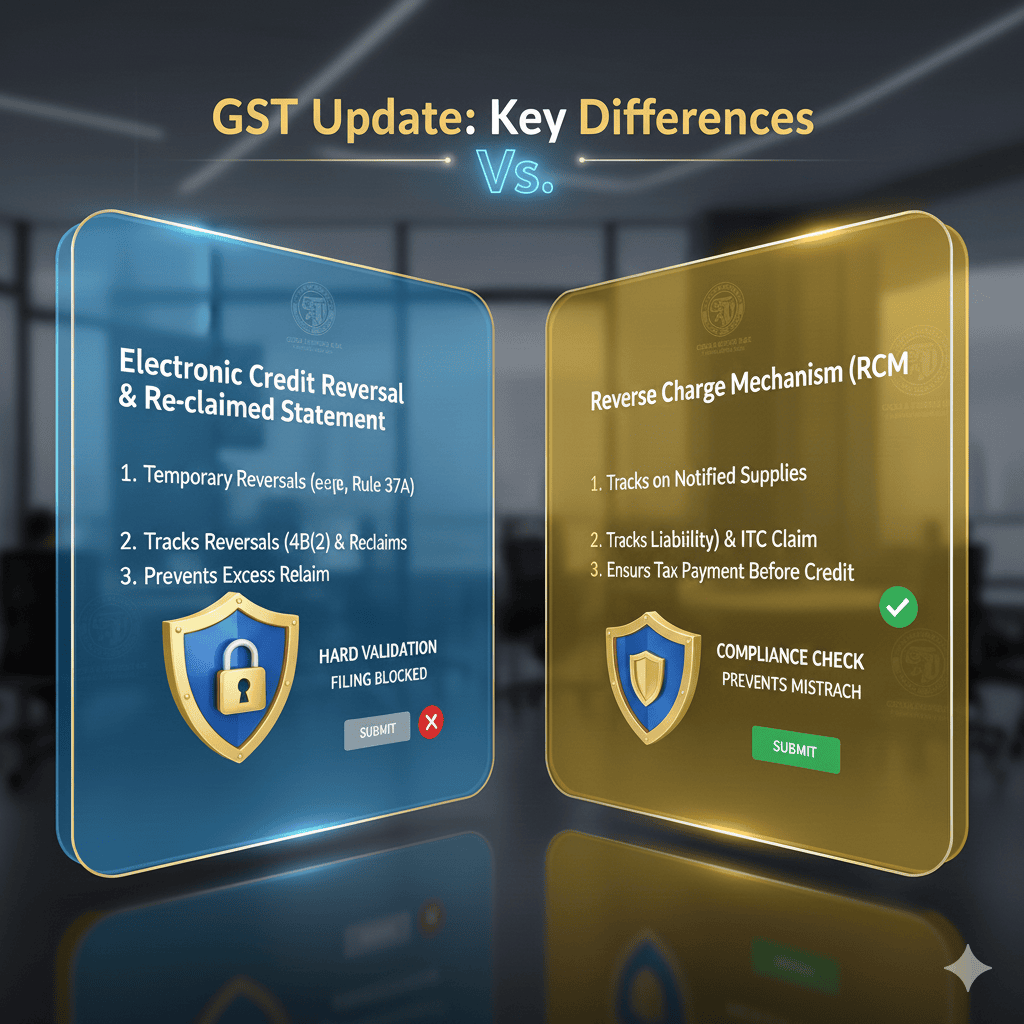

To avoid clerical mistakes and excess ITC claims, GSTN has introduced two ledgers on the GST portal:

These ledgers help taxpayers correctly track ITC reversal, re-claim and RCM-related ITC.

Going forward, taxpayers will not be able to file GSTR-3B if excess ITC is claimed beyond available ledger balance.

This article explains the update in simple language.

✅ What is the Electronic Credit Reversal & Re-claimed Statement?

This ledger tracks ITC that is:

🔹 Temporarily reversed in

Table 4(B)(2) – ITC Reversed (Other than Rule 42/43)

and later

🔹 Re-claimed in

Table 4(A)(5) and Table 4(D)(1)

This system is active from:

✔ August 2023 — Monthly taxpayers

✔ July–September 2023 — Quarterly taxpayers

Purpose of the Reclaim Ledger:

✔ Avoid double reclaim of ITC

✔ Maintain ITC audit trail

✔ Reduce reporting mistakes

You can view the ledger by navigating:

Dashboard ➜ Services ➜ Ledger ➜ Electronic Credit Reversal & Re-claimed

✅ What is the RCM Liability / ITC Statement?

This ledger tracks:

✔ RCM liability paid in

Table 3.1(d) — RCM Tax Payable

and

✔ ITC claimed on RCM in

Table 4A(2) & 4A(3)

This is available from:

✔ August 2024 — Monthly taxpayers

✔ July–September 2024 — Quarterly taxpayers

You can access it here:

Dashboard ➜ Services ➜ Ledger ➜ RCM Liability / ITC Statement

⚠️ Earlier — Only Warning Messages Were Shown

Earlier, if taxpayers:

❌ claimed excess ITC

❌ reclaimed ITC without sufficient reversal balance

❌ claimed more RCM ITC than liability

The portal displayed a warning message, but GSTR-3B filing was still allowed.

Now GSTN has introduced strict system validation.

🚦 New Validation Rules — Very Important

Going forward:

❌ Negative ledger balance will not be allowed

❌ Excess ITC claim will block GSTR-3B filing

🔹 Rule for Reclaim Ledger (ITC Reversal & Re-claim)

ITC reclaimed in Table 4(D)(1) must be:

👉 Less than or equal to:

✔ Closing balance in Reclaim Ledger

+

✔ ITC reversed in Table 4(B)(2) in the same return period

If reclaim exceeds allowed balance →

🚫 GSTR-3B cannot be filed

🔹 Rule for RCM Ledger

RCM ITC claimed in Table 4A(2) & 4A(3) must be:

👉 Less than or equal to:

✔ RCM liability in Table 3.1(d)

+

✔ Closing balance in RCM Ledger

If excess RCM ITC is claimed →

🚫 GSTR-3B filing will be blocked

🚫 If Ledger Balance is Already Negative — Filing Will Be Restricted

A negative balance means:

❌ excess ITC was claimed earlier

To file returns, taxpayer must:

🟡 Case 1 — Negative Balance in Reclaim Ledger

✔ Reverse excess ITC in Table 4(B)(2)

If no ITC is available:

👉 reversal amount will be added to liability

🟡 Case 2 — Negative Balance in RCM Ledger

Taxpayer must either:

✔ Pay additional RCM in Table 3.1(d)

OR

✔ Reduce RCM ITC in Table 4A(2) / 4A(3)

Only after correction →

✔ GSTR-3B filing will be allowed

🧠 Why GSTN Introduced These Ledgers?

To prevent:

❌ wrong or excess ITC reclaim

❌ double claiming of RCM ITC

❌ clerical reporting mistakes

❌ litigation & notices

To promote:

✔ transparent ITC reporting

✔ self-reconciliation

✔ stronger compliance discipline

💡 What Taxpayers Should Do Now

Businesses should start:

✔ Regularly reviewing both ledgers

✔ Reconciling ITC reversal & reclaim

✔ Matching RCM liability vs RCM ITC

✔ Avoiding reclaim without available balance

This will help avoid:

🚫 Return filing blockage

🚫 ITC recovery demands

🚫 Interest & penalties

🚫 GST department notices

🟢 Conclusion — Key Takeaway

GSTN has moved to a ledger-based ITC validation system.

From now on:

✔ ITC can be reclaimed only when reversal balance exists

✔ RCM ITC can be claimed only when liability is paid

✔ Negative balance must be corrected before filing

This ensures:

👉 accurate ITC reporting

👉 better transparency

👉 improved compliance