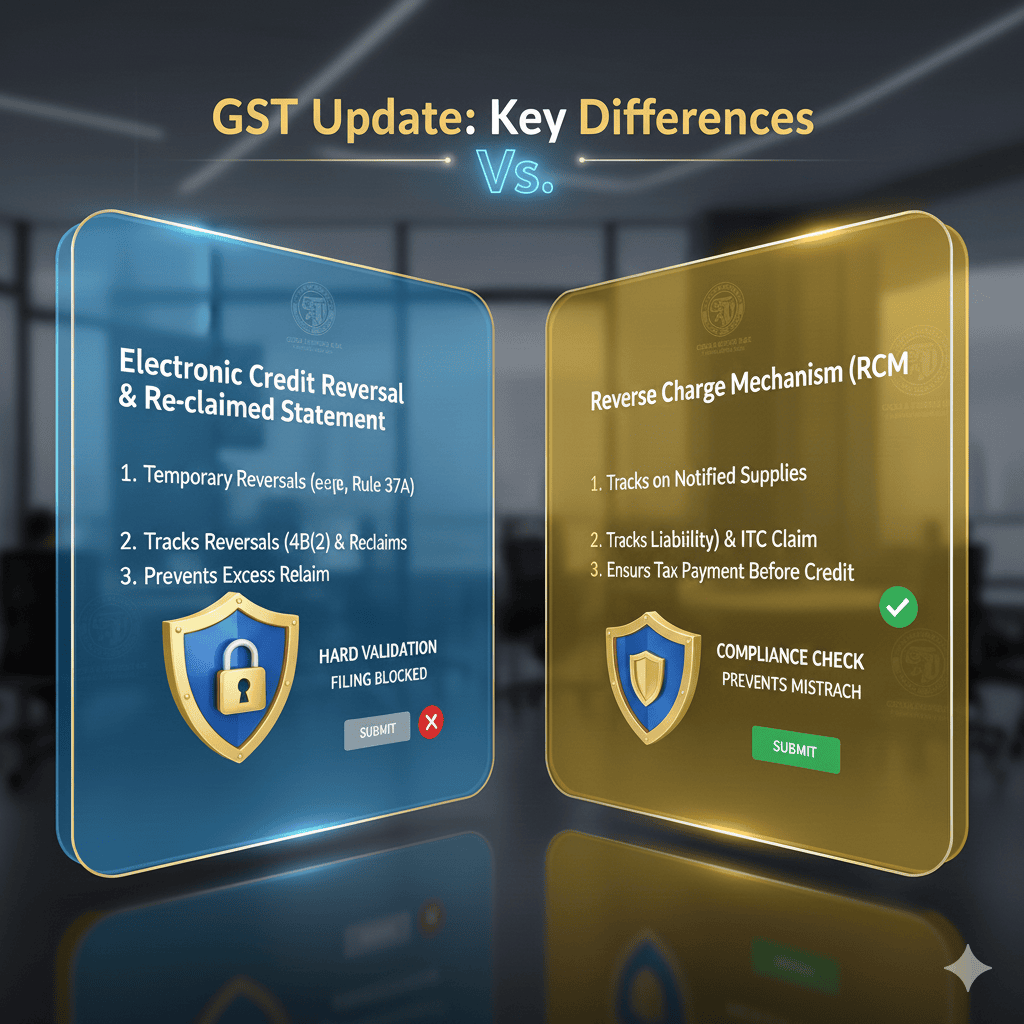

The GST Network (GSTN) has issued an important update regarding the reporting of: ✔ ITC reversal and re-claim ✔ RCM liability and corresponding ITC claim. To avoid clerical mistakes and excess ITC claims, GSTN has introduced two ledgers on the GST portal

06.01.26 04:49 AM - Comment(s)