Explained in Simple Language for Common People

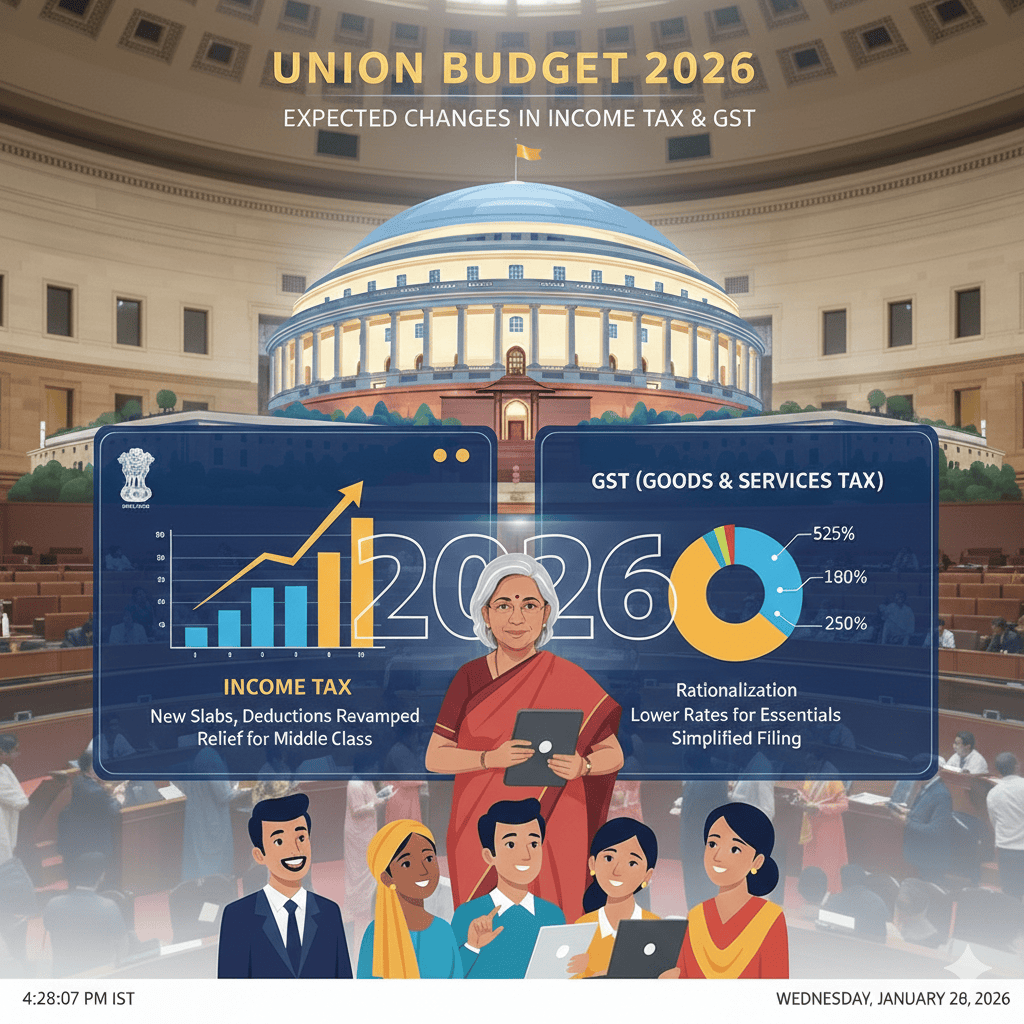

Every year, the Union Budget decides how much tax we pay and how easy or difficult compliance will be. As Budget 2026 approaches, salaried people, business owners, and professionals are all hoping for relief, clarity, and simplicity.

Let’s understand what changes are expected in Income Tax and GST — in very simple words.

🔹 PART 1: Expected Changes in Income Tax (For Individuals & Salaried People)

1️⃣ Higher Standard Deduction – More Salary in Hand

👉 What is standard deduction?

It is a fixed amount reduced from your salary before tax is calculated.

📌 Current position: ₹75,000

📌 Expected change: Increase to ₹1,00,000

✅ What it means for you:

No bills required

Less taxable income

More monthly take-home salary

Example:

If your salary is ₹10 lakh, extra ₹25,000 deduction means direct tax saving.

2️⃣ No Major Income Tax Slab Changes (Likely)

Many people expect big slab changes, but realistically:

❌ No drastic slab overhaul

✅ Only small fine-tuning, if any

Why?

Because the government already made major changes in earlier budgets and wants to control the fiscal deficit.

👉 Layman takeaway:

Don’t expect “zero tax till ₹10 lakh” kind of announcements — relief will be gradual.

3️⃣ Home Loan Tax Benefit May Increase 🏠

📌 Current rule:

Interest deduction on self-occupied house = ₹2 lakh

📌 Expectation:

Limit may be increased due to rising property prices

✅ Who benefits?

Middle-class home buyers

First-time house owners

👉 This can reduce your tax burden if you are paying high EMI interest.

4️⃣ More Clarity on Crypto & Foreign Income 💻🌍

Many taxpayers are confused about:

Crypto tax

Foreign income

Foreign tax credit

📌 Expected:

Clearer rules

Less confusion

Fewer notices

👉 Layman meaning:

Less tension and fewer mistakes while filing returns.

5️⃣ Relief for Senior Citizens 👴👵

Senior citizens face:

High medical expenses

Limited income sources

📌 Expected:

Higher deduction for medical expenses

Possibly higher exemption limits

👉 This would help retirees live with more financial comfort.

6️⃣ Simpler Income Tax Filing

Government focus is shifting to “trust-based and tech-based” taxation.

📌 Expected improvements:

Better pre-filled returns

Fewer notices for small mistakes

Less penalty for genuine errors

👉 Meaning for common man:

Income tax filing becomes less scary.

🔹 PART 2: Expected Changes in GST (For Business & Traders)

1️⃣ GST Will Become Simpler (GST 2.0)

GST is improving slowly, not suddenly.

📌 Expected improvements:

Easier return filing

Better matching of ITC

Less blockage of working capital

👉 Small businesses will find GST less complicated than today.

2️⃣ GST Rate Rationalisation (Fewer Rates)

Currently GST has:

0%, 5%, 12%, 18%, 28%

📌 Expectation:

Fewer slabs

Many items shifted to 5% or 18%

👉 Why this helps:

Less confusion

Fewer classification disputes

Easier billing

3️⃣ Relief for Essential Goods & Services

There is growing demand to:

Reduce GST on medicines

Rationalise GST on health-related items

👉 Benefit:

Lower cost for common people.

4️⃣ Fewer Notices & Litigation

📌 Expected changes:

Less aggressive GST notices

More focus on genuine tax evasion

Less harassment for small errors

👉 Honest taxpayers can do business peacefully.

5️⃣ Better GST-Customs Coordination (For Importers & Exporters)

Businesses want:

Simple customs duty structure

Faster clearances

Less classification disputes

👉 Helpful for exporters, traders, and manufacturing units.

.🔹 What Does Budget 2026 Mean for You?

👨💼 Salaried Employees

✔ Higher standard deduction

✔ More clarity

✔ Easier tax filing

🏪 Small Businesses

✔ Simpler GST

✔ Less compliance stress

✔ Better cash flow

🏠 Home Buyers

✔ Possible higher tax benefit

✔ EMI burden relief

👵 Senior Citizens

✔ Better medical deductions

✔ Improved financial security

🔚 Final Words

Budget 2026 is expected to focus on “simplification, stability, and gradual relief” rather than big surprises.

Instead of flashy announcements, the government is likely to:

Reduce confusion

Improve compliance

Make taxation more taxpayer-friendly

📌 For common people, the goal is simple:

Pay correct tax, file easily, and live tension-free.