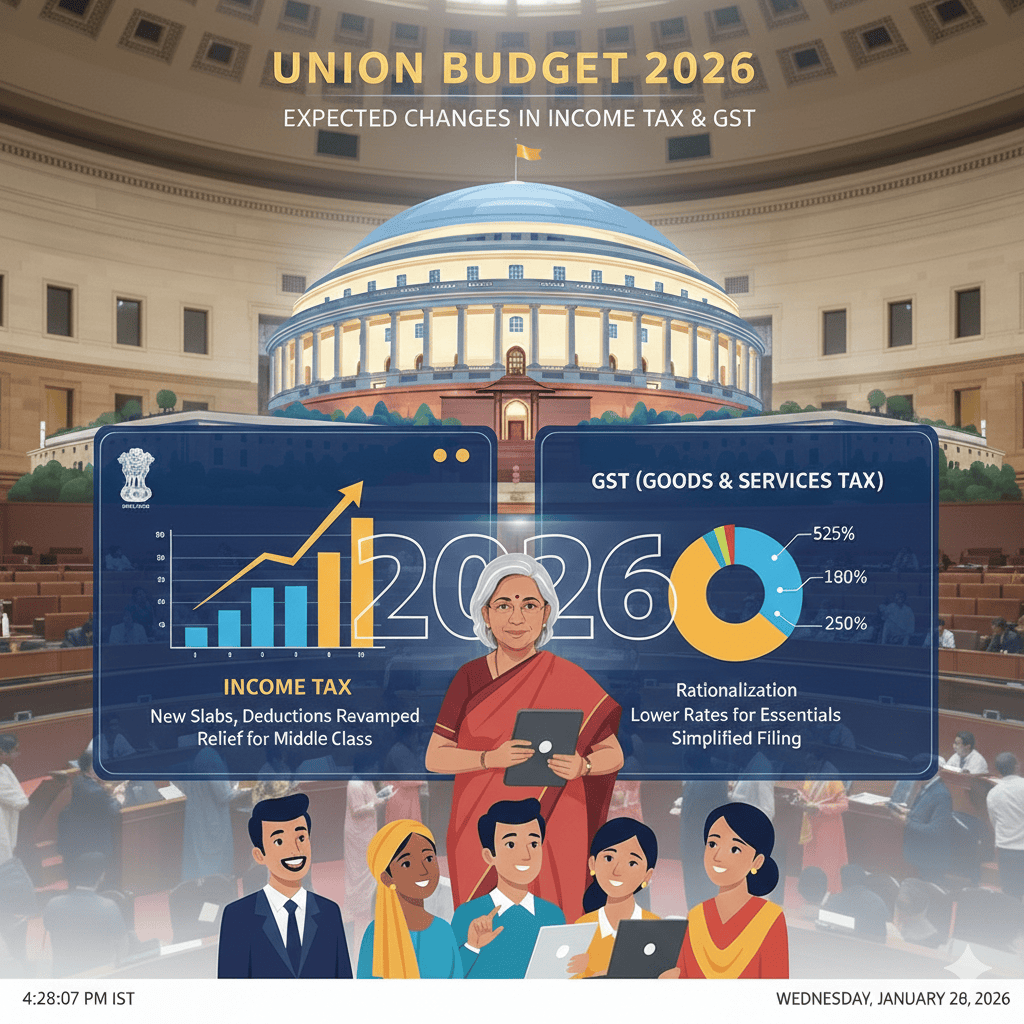

Every year, the Union Budget decides how much tax we pay and how easy or difficult compliance will be. As Budget 2026 approaches, salaried people, business owners, and professionals are all hoping for relief, clarity, and simplicity.

Let’s understand what changes are expected in Income Tax and GST —...

28.01.26 12:26 PM - Comment(s)